36+ How much loan can i get for mortgage

But to compensate for the low downpayment FHA loans require a mortgage insurance premium. They can either opt to receive a lump sum or receive periodic funding over an agreed number of years.

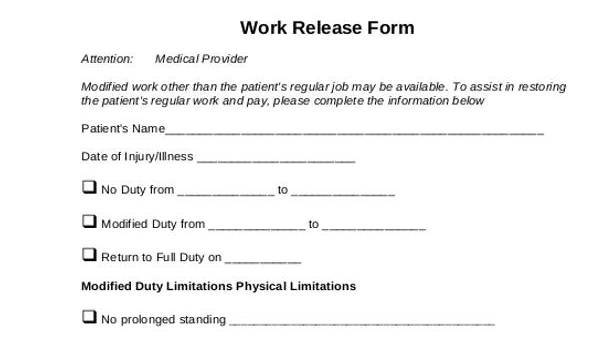

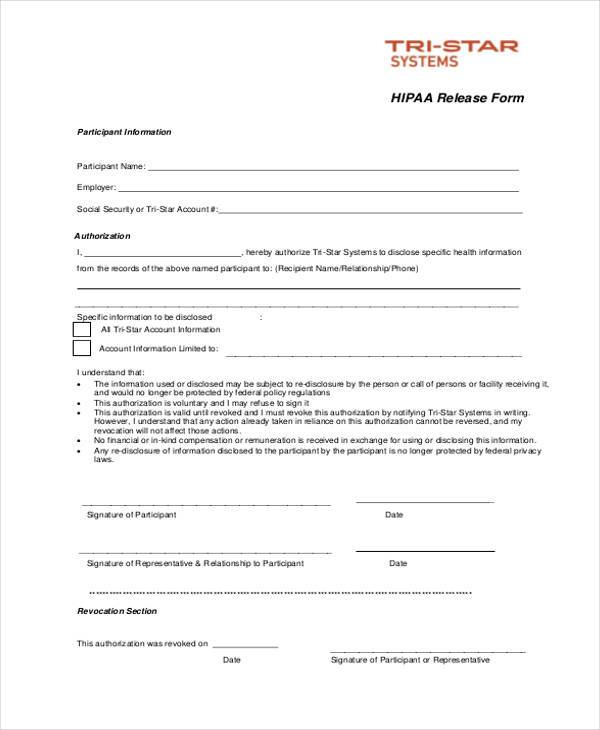

Free 36 Generic Release Forms In Pdf Ms Word

Choose a loan with a lower start rate for instance a 5-year adjustable rate mortgage instead of a 30-year fixed loan.

. Your total interest on a 1000000 mortgage. Current Redmond Mortgage Refinance Rates on a 260000 Fixed-rate Mortgage. You can compare mortgage loan terms to see how different mortgage agreements impact your homebuying budget.

Some banks also offer mortgage loans up to Rs10 crore. So for a 100000 mortgage youd need a down payment of 20000 excluding closing costs and taxes. The applicant can opt to receive disbursement in two ways.

Lenders typically require a down payment of at least 20. Mortgage loans to irrevocable trusts are short-term loans and typically used to help the successor trustees and beneficiaries equalize the distribution of the assets of the trust. You can use a personal loan calculator to get an idea of what you can expect to pay.

At 60000 thats a 120000 to 150000 mortgage. With a 100000 salary you have a shot at. Expect a lender to ask you about your income assets.

You can edit your loan term in months in the affordability calculators advanced options. Whats Your Maximum Preapproval Amount. Adding to your down payment also increases how much home you can afford.

The type of mortgage you choose can have a dramatic impact on the amount of house you can afford especially if you have limited savings. A personal loan is repaid in monthly installments similar to a car loan or home mortgage with loan terms typically ranging from 24 months to 60 months or even longer. The most common term for a mortgage is 30 years or 360 months but different terms are available depending on the type of home loan that works best for your situation.

Then divide that total by 12 for your maximum monthly mortgage payment. 20 of 220000 44000 down payment. This option is appropriate for first-time homebuyers with less than perfect credit scores.

For example if you can afford a mortgage payment of 1650 you might only be sending 1326 toward your actual mortgage each month after paying 104 for insurance and 220 for property taxes. Most lenders prefer 28. Should Ideally be 36.

If this is the maximum conforming limit in your area and your loan is worth 600000 your mortgage can be sold into the secondary market as a conventional loan. Buyers should consider asking the seller to contribute toward closing costs. Some loan programs place more emphasis on the back.

This would leave 176000the amount a home buyer will need for the mortgage. Usually the amount of funding you can avail will be up to 60 of the registered value of the property. This rule takes the 28 rule one step further.

Home Loan Based With a 36 Back End DTI. The trust loan lenders also have flexible lending criteria and can fund much more quickly than traditional lenders 5-7 days vs 45-60 days. Pre-qualification is a casual estimate that determines how much money you can borrow for a mortgage.

The interest rates on mortgage loans range from 815 to 1180 pa. If you instead opt for a 15-year mortgage youll pay over the life of your loan or about half of the interest youd pay on a 30-year mortgage. A mortgage loan is one in which you secure funds by pledging your property.

Maximum is 50 with compensating factors Most lenders accept 43 Should Ideally be 36. How Much Mortgage Can I Afford if My Income Is 60000. Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older.

The length by which you agree to pay back the home loan. In case of joint applicants the loan can be recovered only after the death of both husband and. Paying a little bit more on your monthly mortgage installments may significantly affect how much home loan you can afford.

One of the first questions you ask when you want to buy a home is how much house can I afford. You can qualify for an FHA loan if you can make a small downpayment 35 percent of the homes value. It states that your total household debt shouldnt exceed 36 so after you factor in the 28 for your mortgage principal and interest you only have 8 remaining for the rest of your bills including car payments student loans and credit cards.

Another reason to aim for 20 down. Some conventional lenders will accept down payments as low as 3 but youll most likely need to purchase private mortgage insurance PMI to secure the loan. FHA loans generally require lower down payments as low as 35 of the home value while other loan types can require up to 20 of the home value as a minimum down payment.

The 28 36 rule. Repayments The property remains in the possession of the applicant during their lifetime. Two criteria that mortgage lenders look at to understand how much you can afford are the housing expense ratio known as the front-end ratio and the total debt-to-income ratio known as the back-end ratio.

The 36 percent model is another way to determine how much of your gross income should go towards your mortgage and can be used in conjunction with the 28 percent rule. On a 30-year mortgage with a 4 fixed interest rate youll pay over the life of your loan. The usual rule of thumb is that you can afford a mortgage two to 25 times your income.

You may qualify for a larger loan if you. Thats about two-thirds of what you borrowed in interest. Youll avoid paying private mortgage.

FHA mortgages usually come in 15 and 30-year fixed rate terms. To calculate u2018how much house can I affordu2019 a good rule of thumb is using the 2836 rule which states that you shouldnu2019t spend more than 28 of your gross monthly income on. A 100K salary puts you in a good position to buy a home.

A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property. This is a general estimate not an actual amount. Here are two examples of what you might pay for a 50000 loan with different terms.

The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments.

Free Resume With Cover Letter Templates Cover Coverlettertemplate Lette Resume Cover Letter Template Cover Letter For Resume Resume Cover Letter Examples

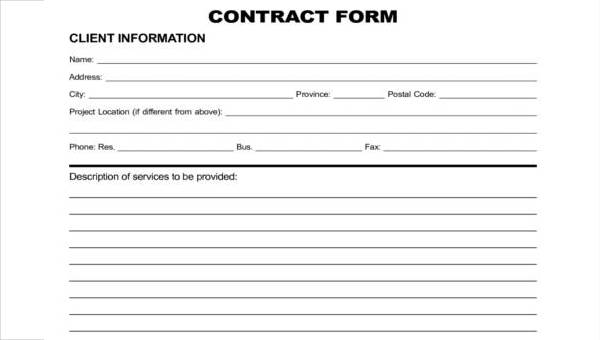

Free 36 Contract Forms In Ms Word

Abraxasdecember2016catal

Free 36 Resignation Letters Samples Templates In Pdf In 2022 Resignation Letters Resignation Letter Sample Resignation

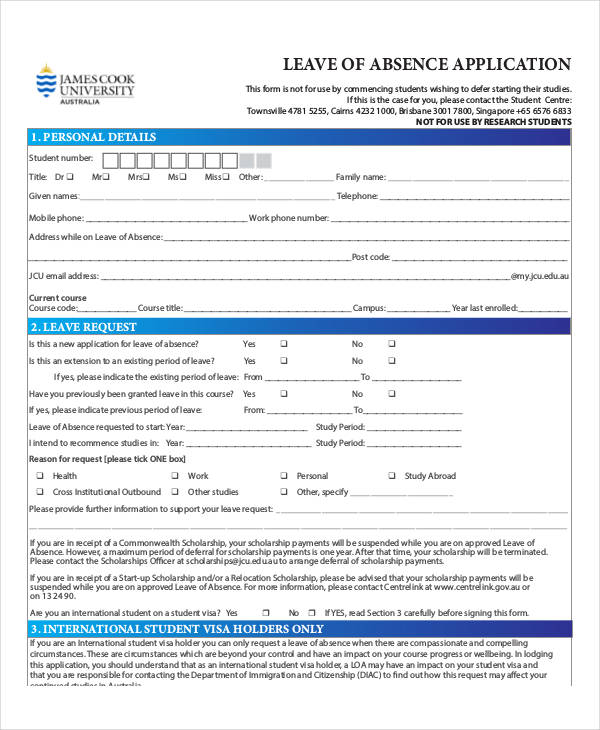

Sample Applications 36 Examples Format Pdf Examples

Abraxasdecember2016catal

Loan Paid In Full Letter Template Letter Templates Lettering Ms Word

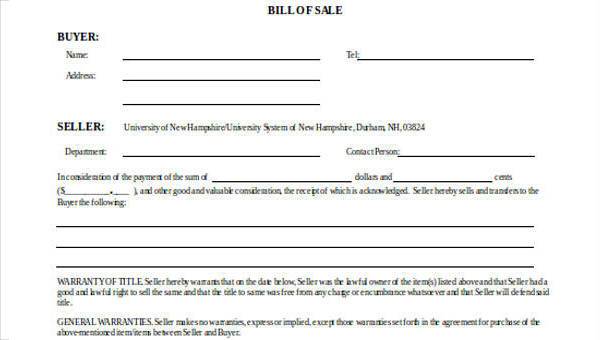

Free 36 Bill Of Sale Forms In Ms Word

36 Pinehurst Dr 36 East Haven Ct 06513 Mls 170520366 Coldwell Banker

36 Easy Places To Get A Cheap Or Free Notary In 2021 Frugal Living Coupons And Free Stuff Frugal Living Coupons And Free Stuff

Socio Economic Impacts Of The Covid 19 Pandemic On New Mothers And Associations With Psychosocial Wellbeing Findings From The Uk Covid 19 New Mum Online Observational Study May 2020 June 2021 Plos Global Public Health

This Article Discusses A Few Of The Legal Issues That Exist With Respect To Teenager Entrepreneurs Starti Financial Education Corporate Law Sales And Marketing

36 Pinehurst Dr 36 East Haven Ct 06513 Mls 170520366 Redfin

36 Collinsbrook Rd Brunswick Me 04011 Mls 1517884 Coldwell Banker

Theunlimitedcreative Com Passive Income Digital Business Artist

36 Collinsbrook Rd Brunswick Me 04011 Mls 1517884 Coldwell Banker

Free 36 Generic Release Forms In Pdf Ms Word